What Does the Goldsmith Use for Money?

Thursday, 10 December 2015Irked by an up-tick in nonsense about money, I decided to haul-out a piece that I'd written years ago on some of the basics of monetary theory — Money 101 as it were — rework some of the old sections, and add some material motivated by new annoyances. I would then post it here.

But, in the course of working on that entry, I was confronted by a problem of that theory. I didn't and don't want just to ignore it, but the Money 101 entry is already rather long. So I decided that I should write a separate entry on the problem.

Part of the difficulty in writing this separate entry is that the problem vanishes if one makes some of the ordinary presumptions of neo-classical economics. I feel that I need to explain why those presumptions should not be made. But, given my audience, I feel that I need to explain the presumptions themselves. This entry may seem still more awkward than usual, as I try not to make it too abstruse.

You'd be quite correct in thinking that this entry could be much better written than it is — if I'd put more time and effort into its composition. But I want to do other things, and don't want this entry to be yet another piece on a back-burner.

Money is a medium of exchange. That is to say that people obtain some amount of it by exchange for the purpose of yet further exchange. It contrasts with things manufactured by them for exchange, and with things obtained for use other than in further exchange. Money arises whenever someone is clever enough to accept more of a commodity than he or she would otherwise want (at the given rate of exchange), and uses it in a further trade. What we ordinarily recognize as money is whatever money has become standard in the exchanges that we observe, but any commodity obtained in one exchange, with the intention of being exchanged yet again, and then indeed thus traded, was money.

Historically, commodity money is routinely followed by commodity-based money, with promissory notes circulating as money. There may at first seem to be no real difference between commodity money and commodity-based money, but fractional-reserve banking actually makes that difference very real, with the promises exceeding the stock of the commodity held to meet those promises, so that the amount of money exceeds the stock of the commodity. And, following upon the introduction of commodity-based money, we observe the introduction of fiat money, where notes that make no promises somehow circulate as money.[1]

Economists — not merely advocates of commodity money or of commodity-based money, but economists more widely — have a great difficulty in explaining why fiat money should have any value in a market economy. We can say a great deal about what prices must obtain if people use some given stock of notes as money for exchanges of some given set of stocks or flows of commodities, and have some given available technologies for transferring these notes, but it seems that we cannot fully explain why people agree to make these exchanges using this money, and hence we cannot explain the value of this money.

On the other hand, most economists seem to be comfortable in the explanation of commodity money and of commodity-based money. It is claimed to be the value of the commodity in non-monetary use. That is to say that to explain the value, for example, of an American silver dollar, one would find the persons who wanted to smith the silver or use it for wiring or somesuch, and see what commodities they would and could offer for that amount of silver. (To express the value in other commodities, one would have to follow a chain of offered exchanges.)

However, this explanation of the value of commodity money and of commodity-based money cannot account for the full value of an indefinitely circulating money.

Before continuing the principal discussion, I want to critique some features of neo-classical economics — the mainstream of micrœconomic theory.[2]

Neo-classical economics proceeds almost entirely within a framework of limiting cases; even when a neo-classical theorist makes a move towards greater reälism with respect to some aspect of the framework, most of the rest of the theorizing retains the familiar limiting-case features. The use of these limiting cases often produces models that are defensible on instrumentalist grounds, but certainly not when they cause whatever is the problem principally under consideration simply to leave sight.

In the case of the problem here to be raised, three of the standard presumptions of neo-classical economics that are objectionable are:

- that preferences are complete

- that goods and services are continuously divisible

- that small costs may simply be ignored

The idea that preferences are complete is that, for absolutely every two potential choices, either a person thinks that one is better than the other, or the person thinks that they are, effectively, equally good. Cases in which people instead behave in some meaningfully different way both from treating the one as better than the other and from treating the two as equally good (or equally bad) are disallowed. I've attacked the literal truth of completeness elsewhere.

The idea that goods and services are continuously divisible might be attacked on the basis of physical theory — what we know of the properties of matter. But, before we pick such nits, I think that we ought to concern ourselves with how finely the human mind actually divides things. Even the folk who carefully eye bottles of water, seeking to determine which is most full, don't get below a particular resolution. And if perfectly accurate and precise measures were always available, then we'd be lost beyond some number of digits to the right of the decimal point.[3] (Our limitations in this regard are entangled with the costs of resolution, which might bring us to the issue of small costs being ignored, except that the costs of ever finer resolution can sky-rocket!)

I don't think that the presumption that small costs may simply be ignored needs much explanation. But note that it can sometimes directly contradict the presumption of completeness of preferences! A cost corresponds to forgone goods or services, and small costs are small variations in the goods or services that one might have had.

I believe that in many other cases, these three presumptions are not a matter of great concern, though they are objectionable in explanation of the value of a money that is a commodity or is based upon a commodity. But there's a fourth presumption that is relevant and that I do not think is ever justified. Specifically

- that, when an agent is otherwise indifferent amongst choices, he or she makes that choice which would be required for the theory to work

That is to say that not only does Buridan's ass choose one of the bails of hay but, if theory won't work unless he chooses the left bail in particular, then he just does. The weaker presumption, that an indifferent agent (person or donkey) will choose, is usually based on a theory that the agent can and will flip a coin

, but the idea that the agent will flip a coin

contradicts expected utility theory, the mainstream of the theory of choice under risk. The stronger presumption that the agent will necessarily just happen to choose whatever is needed for the rest of the theory to work is incoherent.

In some contexts, most people understand that, for any person to agree to an exchange, he or she must expect to be better-off if the exchange takes place than if it does not. Most people lose sight of that point in a variety of contexts; some screw their eyes shut so as not to see it. Under the presumptions of neo-classical economics, it can be made to disappear.

Imagine that Ann has some quantity of blackberries, and Bob has some quantity of strawberries, and that Ann would rather have the strawberries that Bob has, and that Bob would rather have the blackberries that Ann has, and that they each feel this way even accounting for the costs of arranging and effecting a trade. In the real world, the trade will take place; and in the neo-classical world the trade will take place. Chances are, the trade would take place even if Ann were offering a slightly smaller quantity of blackberries while Bob offered the same amount of strawberries. In the real world, if we decrease the quantity of blackberries below some point, Bob may still think that the blackberries would have been worth it, except for the hassle of negotiation and transfer; in the neo-classical world, that hassle is usually considered small enough to ignore. So we leave reality behind, and can keep paring-back the offered amount of blackberries. We can do so with infinite precision, because blackberries are imagined to be continuously divisible, and because Bob is imagined to have complete preferences. Eventually, we reach the point at which the offered amount of blackberries is worth exactly as much to Bob as the strawberries that he has. But, at every place up to that point, he would agree to a trade; to put that in mathematical jargon, so long as there is any ε (no matter how tiny) of blackberries greater than the amount at which he is indifferent, neo-classical Bob will make the trade. So the claim is that, at the limit, he will still make the trade, even though he has nothing to gain. Mind you that this is a limit approached from one side. If the epsilons were all short-falls, rather that surpluses, then Bob would have been refusing right up to the limit. Still, neo-classical Bob might work well enough as a model for real-world Bob if short-falls just never occur for him. If they do, it would be quite terrible to claim that the behavior to one side of the limit (by even an ε) is the behavior when approached from the other side, and that Bob both trades and refuses to trade at the limit, or trades both ways (strawberries for blackberries or blackberries for strawberries) at the limit.[4]

The value of an additional amount, more or less, of strawberries or of blackberries relative to other possible changes, doesn't typically stay the same. In particular, as one has ever more of something, one would increasingly find more of something else relatively more useful; and as one has ever less of something, one would increasingly find more of something else less useful.[5] As a result, under the presumptions of neo-classical economics, one could expect that, by playing with the amounts of blackberries that Ann has, and the amount of strawberries that Bob has, one could produce a situation in which each valued what they had equal to what the other had. Given these presumptions, as soon as Ann and Bob have made a trade, they might be willing to make the inverting trade, so that they end-up where they were! And I've seen models in which it is implicit that just this sort of thing happens!

So long as we understand these assumptions as producing imperfect instruments, they may have great value. Newtonian physics has been empirically falsified, and never really held together, but it works fine not merely for much technology, but for investigating the basic answer to various scientific questions. Likewise for some applications of neo-classical economics. But one must not confuse artefacts of counter-factual assumptions with actual answers to whatever questions are at hand.

Imagine three people, Aya, Gus, and Tor. Aya has a pepper but wants strawberries; Gus has strawberries but wants okra; Tor has okra but wants a pepper.

| Agent | has | wants |

|---|---|---|

| Aya | pepper | strawberries |

| Gus | strawberries | okra |

| Tor | okra | pepper |

Aya can get what she really wants by using okra as a medium of exchange (trading the pepper for okra and then the okra for strawberries); or Gus can get what he wants by using the pepper as a medium of exchange (trading the strawberries for the pepper and then the pepper for okra); or Tor can get what he wants by using the strawberries as a medium of exchange (trading the okra for the strawberries and then the strawberries for the pepper).

But if the only potential use that Aya has for the okra is as a medium of exchange, and likewise for Gus with the pepper and for Tor with the strawberries, then it will not make sense for Aya to use the strawberries as a medium of exchange, for Gus to use okra as a medium of exchange, nor for Tor to use the pepper as a medium of exchange. No matter what is used as money, the person responsible for its having value in exchange is also a sink for the money; once it is in his or her hands, it will cease to circulate as money.

One might imagine a larger community, in which the money had to pass through more hands to reach a sink. But the reasoning that launched the money was based upon its value to a person who would be a sink. If the money could not be expected to reach a sink, it could not be expected to reach the person who gave it value. It seems that it must go to a sink to be money.

My model of Aya, Gus, and Tor has only persons each of whom places no value on the item for which he or she could initially trade, except as a medium of exchange; and the trades considered are those in which each person gives all of his or her stock. We can imagine an economy with a large number of people, many or all of whom place some value on various or all of the sorts of commodities that might be used as money. We may presume that some goods and services are possessed by more than one person and that some goods and services are sought by more than one person. For various potential transactions, we might suppose competition both amongst those seeking the monetary commodity (for use as money or for non-monetary use) and amongst those offering the monetary commodity to them. We may conceive that many stocks of goods and of services are divisible.

When stocks of a commodity are divisible it becomes possible (and sometimes necessary) to put some portion to one use and the remainder into another use or into other uses. Various portions may be traded with various persons, and some may be put to use other than in exchange; and these different sorts of allocation of different portions may make sense because (as said earlier) as one has ever more of something, one would increasingly find more of something else relatively more useful; and as one has ever less of something, one would increasingly find more of something else less useful. It certainly becomes conceivable for some people to acquire both stocks of the monetary commodity for use as money and stocks for non-monetary use.

But, even with these added complications, it seems that the persons responsible for the monetary commodity having value in exchange are also sinks for the money; once it is in their hands, it will cease to circulate as money.

Whatever may be their priorities, rational people make only trades that they regard as improving expectations, and do not forgo greater such improvements for lesser improvements. In a neo-classical framework, that improvement might be imagined to be 0, the ghost of a departed ε, but in the real world it must be more than that. Trading with the monetary commodity is no exception to the rule that rational people do not trade unless they expect their priorities to be best served by the trade.

If a person wants a positive amount of the monetary commodity for use in trade, that means that (given his or her priorities) the anticipated value of the use of that portion as money exceeds the anticipated value of that portion in other use; it must be expected that someone will give give something worth more than that other use. We may then consider that next person. Either he or she will put the whole to non-monetary use, removing it from circulation as money, or will reserve some for monetary use. But we cannot indefinitely pass the buck if we are explaining the value of the monetary commodity by its non-monetary use. Eventually, either all of the commodity will have been removed from monetary use, or we will be back to someone whose position has already been considered. If money circulates indefinitely then it must for all participants have a greater value than they place on its non-monetary use!

My understanding of the relevant history is more limited than that of some people, but I think that some commodity money and commodity-based money has enjoyed enough circulation to indicate or at least to suggest that it might well circulate forever, that its value as money is not fully explained by its value in non-monetary use. [Addendum (2015:12/13): The recurring practice of fractional-reserve banking is only sustainable if money circulates indefinitely. Some opponents of the practice may insist that it is unsustainable; but, in any case, the monetary commodity must be fairly far removed from a sink for fractional-reserve banking to work at all, and frequent observation of fractional-reserve banking suggests that money indeed circulates indefinitely.]

If that is correct, then we want to explain the additional value. And, quite possibly, we might find in such an explanation something that will help us to explain the value of fiat money.

[1] At least passing mention should be made of the point that, if what appears to be fiat money is legal tender and there are price controls, then the money may be considered to be backed by the price-controlled commodites, or perhaps by the punishment delivered to those who fail to produce the commodities at those prices when the money is presented.

[2] There is no objection to marginalism here. Although both neo-classical economists and opponents of marginalism often treat them as if conterminous, they are not.

[3] With limited bearing on the problem of money, but of potential interest in other contexts, there is an additional issue of divisibility for commodities that are not simply measures of a substance, of space, or of time. Dividing something such as a car in two is not like dividing water into two containers. If for every proposed fractionalization (a half, a third, a fourth, &c) we could somehow find or construct some car which under natural descriptions had that fraction of each feature of another car (half as much leg-room, half as much cargo space, &c) and such that all persons regarded the corresponding multiplicity of these lesser cars as equivalent to one of the larger cars, then we might have a case for a sort of divisibility. But those conditions cannot be met.

[4] It would be then as if one claimed that, within a range from 0 to π, tan(π/2) were variously positive and negative simply whenever that makes a theory work.

[5] This is the actual law

of diminishing marginal utility, though neo-classical economics gets lost in a special case of the principle.

![[formal logical expression]](wp-content/uploads/2015/09/not_not_know_why_like_hitler.png) So,

So,

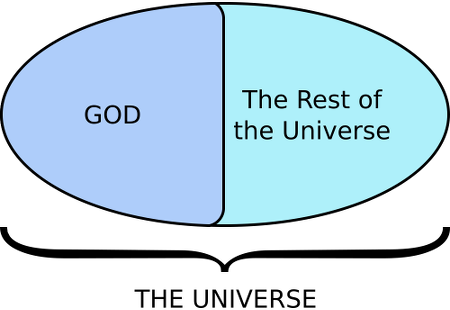

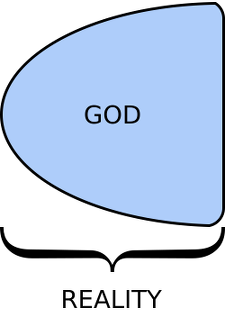

However, a lot of theïsts want to assert that G_d is outside of what they call

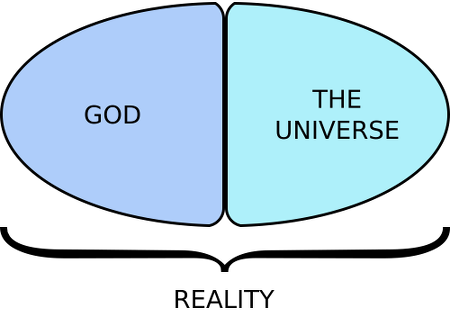

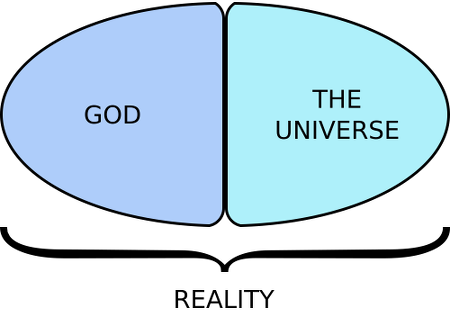

However, a lot of theïsts want to assert that G_d is outside of what they call  Likewise, for those who more generally claim that G_d not is not entirely contained by what they call

Likewise, for those who more generally claim that G_d not is not entirely contained by what they call

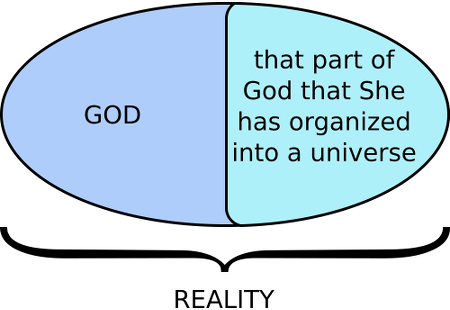

or perhaps within Her (in which case we might speak and write of two parts, one of them being the universe, and the other being the rest of G_d)

or perhaps within Her (in which case we might speak and write of two parts, one of them being the universe, and the other being the rest of G_d)  or perhaps partially internal to Her and partially external.

or perhaps partially internal to Her and partially external.